How Much Is Mileage Reimbursement 2025 Uk

How Much Is Mileage Reimbursement 2025 Uk

For 2025 for cars, motorcycles, and bicycles. From 1 june 2025, the advisory electric rate for fully electric cars will be 8 pence per mile.

This is covered in travelperk’s short guide to mileage allowance in the uk. Hmrc mileage rates 2025 will entitle your staff to claim hmrc mileage allowance when driving personal vehicles for business purposes.

Hybrid Cars Are Treated As Either Petrol Or Diesel Cars For Advisory Fuel.

The hmrc mileage rates offer a standardized approach to mileage reimbursement, but calculating the exact amount can be tedious.

The Mileage Allowance Relief Claim Is Based On Hmrc’s Approved Mileage Rates.

You can use our hmrc mileage rates calculator to work out how much you will receive in mileage allowance payments based on your driving.

Images References :

Source: saschawgill.pages.dev

Source: saschawgill.pages.dev

Mileage Reimbursement 2025 Uk Cyndie Iormina, In this blog, we will help you to understand the rules of hmrc mileage allowance and provide you with the latest 2025 hmrc mileage rates for business. The official hmrc business mileage rates for the tax year 2025/2025 are now confirmed, at 45p per mile for cars and vans.

Source: rubyqjoanne.pages.dev

Source: rubyqjoanne.pages.dev

Mileage Cost Calculator 2025 Alika Beatrix, In this blog, we will help you to understand the rules of hmrc mileage allowance and provide you with the latest 2025 hmrc mileage rates for business. In the 2025/24 tax year, mileage rates are currently set at 45p per mile for the first 10,000 miles for cars and vans.

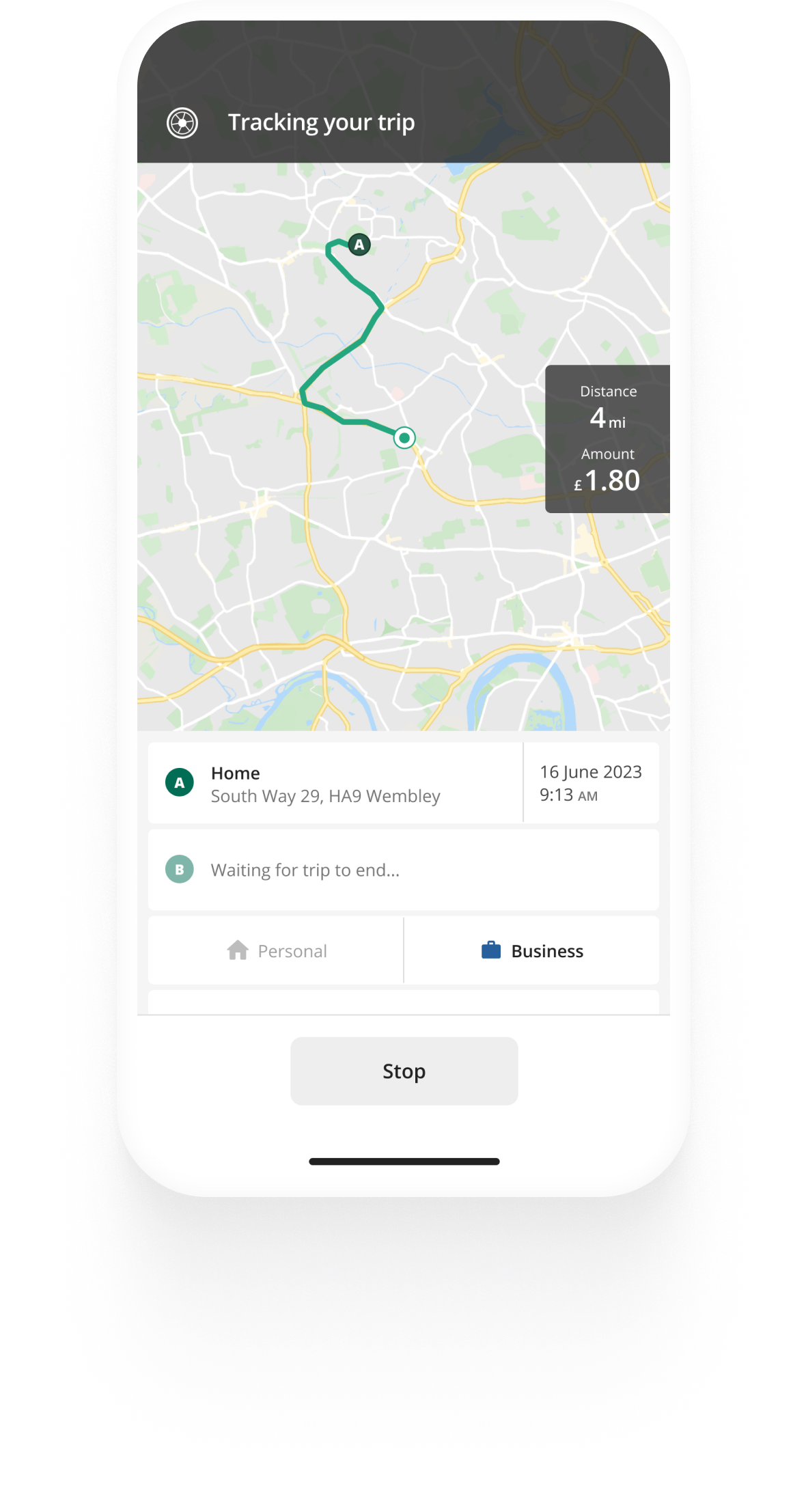

Source: www.driversnote.co.uk

Source: www.driversnote.co.uk

HMRC mileage rates 2025, How to calculate mileage expenses. The hmrc mileage rates offer a standardized approach to mileage reimbursement, but calculating the exact amount can be tedious.

Source: malissawjoann.pages.dev

Source: malissawjoann.pages.dev

Mileage Reimbursement 2025 Uk Date Iona Renate, Alternatively, i can use my own car with irs mileage reimbursement (2025 rate: The current hmrc approved mileage rates vary depending on the type of vehicle used for business purposes.

Source: dynahqrosabella.pages.dev

Source: dynahqrosabella.pages.dev

Business Miles Reimbursement 2025 Rate arlyne jillene, For 2025 for cars, motorcycles, and bicycles. With the hmrc set mileage allowance, the same rate is applied for every employee, depending on the type.

Source: joeyqleontine.pages.dev

Source: joeyqleontine.pages.dev

Irs Electric Vehicle Mileage Rates 2025 Annie, In this post, you can find our hmrc mileage claim calculator which calculates your mileage allowance using the mileage rate for 2023 and 2025 provided by. Alternatively, i can use my own car with irs mileage reimbursement (2025 rate:

Source: clioqlulita.pages.dev

Source: clioqlulita.pages.dev

Gas Mileage Reimbursement 2025 Calculator Katya Melamie, How much is the hmrc 2025 mileage allowance? In this blog, we will help you to understand the rules of hmrc mileage allowance and provide you with the latest 2025 hmrc mileage rates for business.

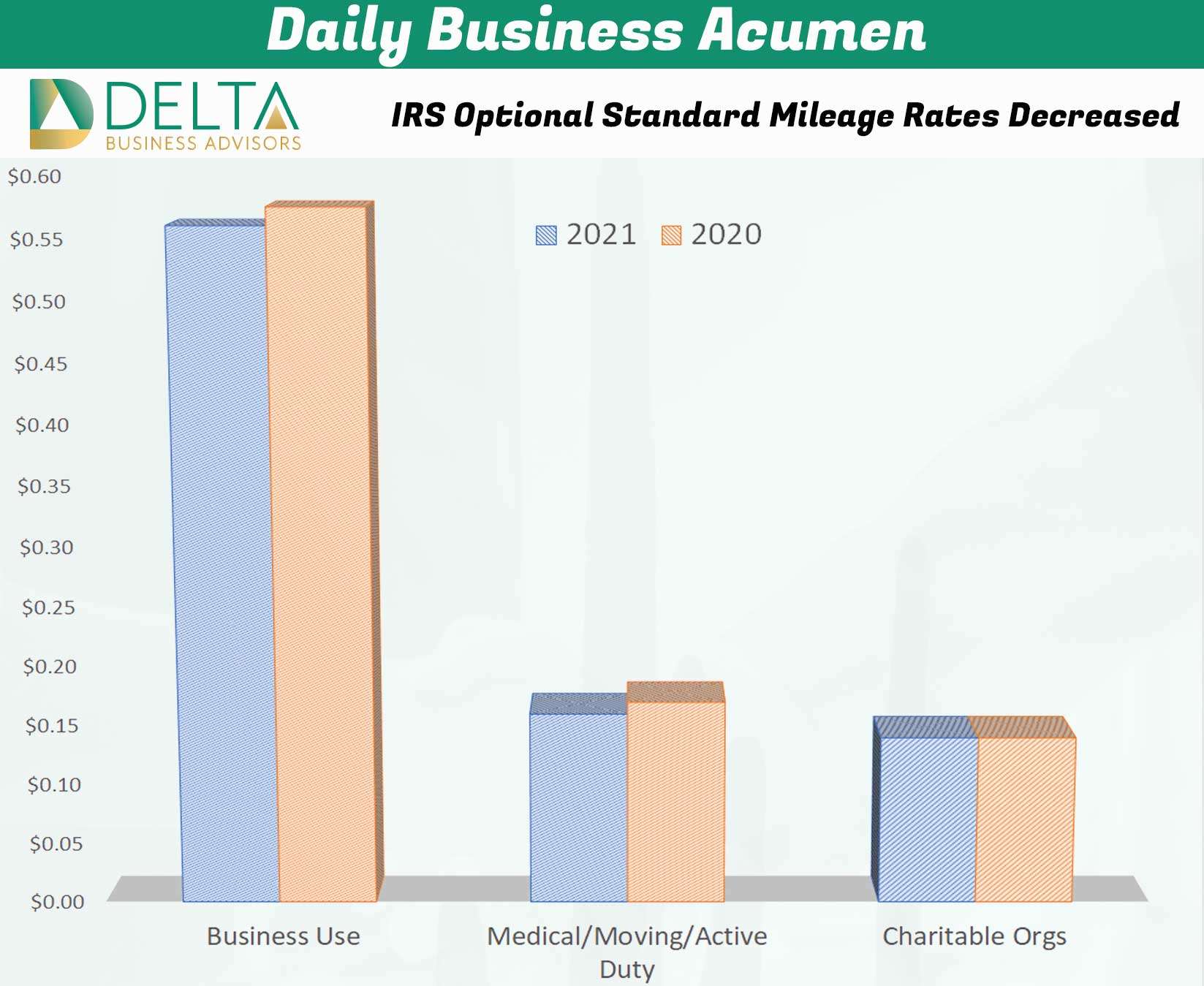

Source: www.irstaxapp.com

Source: www.irstaxapp.com

2025 & 2023 Mileage Reimbursement Calculator Internal Revenue Code, The 2025 hmrc rates are: How much is the hmrc 2025 mileage allowance?

Source: issuu.com

Source: issuu.com

How To Calculate Mileage Reimbursement by Kliks App Issuu, How much is the hmrc 2025 mileage allowance? The current hmrc approved mileage rates vary depending on the type of vehicle used for business purposes.

Source: www.youtube.com

Source: www.youtube.com

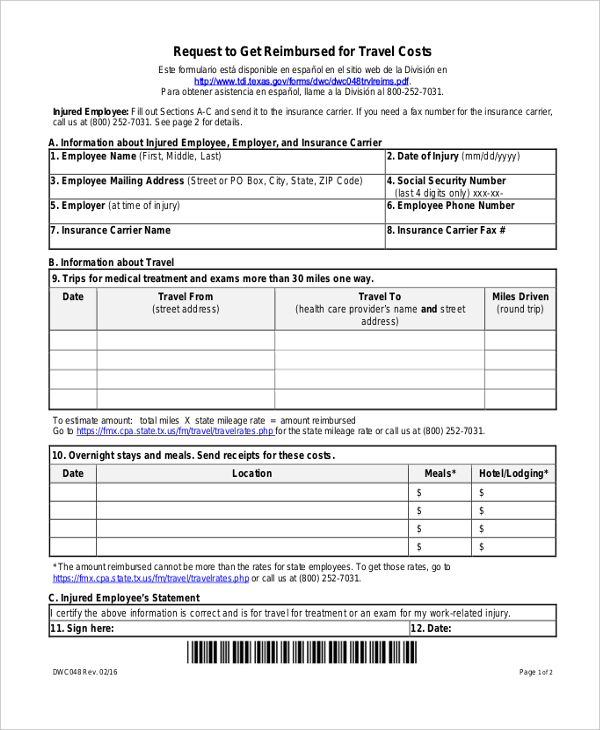

What is a Mileage Reimbursement Form EXPLAINED YouTube, You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable, business, or moving. For 2025 for cars, motorcycles, and bicycles.

Alternatively, I Can Use My Own Car With Irs Mileage Reimbursement (2025 Rate:

With the hmrc set mileage allowance, the same rate is applied for every employee, depending on the type.

You Can Use This Mileage Reimbursement Calculator To Determine The Deductible Costs Associated With Running A Vehicle For Medical, Charitable, Business, Or Moving.

The 2025 hmrc rates are:

Posted in 2025